How to Securely Order Cryptocurrencies: A Detailed Overview for Beginners

How to Securely Order Cryptocurrencies: A Detailed Overview for Beginners

Blog Article

Recognizing the Fundamentals of Cryptocurrencies for Beginners

The landscape of cryptocurrencies presents a complex yet intriguing opportunity for newcomers to the financial globe. Recognizing what cryptocurrencies are, just how blockchain modern technology underpins their procedure, and the different kinds offered is vital for educated participation.

What Are Cryptocurrencies?

Although the concept of currency has actually progressed substantially gradually, cryptocurrencies represent an innovative shift in how worth is traded and kept (order cryptocurrencies). Defined as electronic or online currencies that utilize cryptography for security, cryptocurrencies run separately of a central authority, such as a federal government or banks. This decentralization is a crucial characteristic that distinguishes them from typical fiat currencies

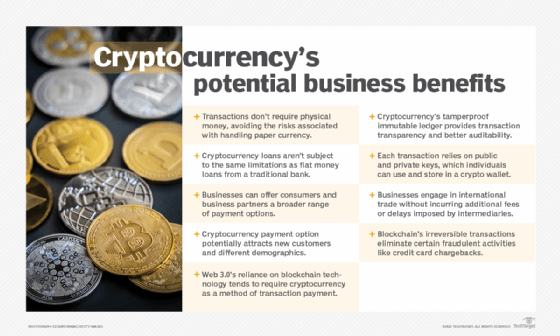

Cryptocurrencies function on a modern technology called blockchain, which makes sure transparency and protection by taping all transactions on a dispersed ledger. This innovation enables peer-to-peer deals without the demand for intermediaries, reducing purchase costs and raising effectiveness. Bitcoin, released in 2009, was the very first copyright and remains one of the most recognized; nevertheless, thousands of options, known as altcoins, have actually since arised, each with unique functions and make use of situations.

The allure of cryptocurrencies hinges on their possibility for high returns, privacy, and the ability to bypass conventional banking systems. They come with fundamental threats, including rate volatility and regulatory unpredictabilities. As cryptocurrencies proceed to acquire grip, understanding their essential nature is essential for anybody aiming to engage with this transformative financial landscape.

Exactly How Blockchain Modern Technology Works

The decentralized nature of blockchain indicates that no solitary entity has control over the entire ledger. Instead, every participant in the network holds a duplicate, which is continually upgraded as brand-new deals happen. This redundancy not only increases security but additionally advertises openness, as all users can verify the transaction background.

To confirm transactions, blockchain employs an agreement device, such as Evidence of Work or Proof of Risk, which needs participants to solve intricate mathematical issues or verify their risk in the network. This procedure discourages malicious tasks and keeps the stability of the journal. Overall, blockchain technology stands for a cutting edge technique to data monitoring, promoting trust and performance in digital transactions without the demand for intermediaries.

Kinds Of Cryptocurrencies

Many types of cryptocurrencies exist in the electronic monetary landscape, each offering unique objectives and performances. The most widely known category is Bitcoin, created as a decentralized digital currency to promote peer-to-peer deals. Its success has actually paved the means for countless different cryptocurrencies, frequently described as altcoins.

Altcoins can be categorized right into several teams (order cryptocurrencies). First, there are stablecoins, such as Tether (USDT) and USD Coin (USDC), which are secured to traditional currencies to minimize volatility. These are perfect for customers seeking stability in their electronic purchases

Another classification is energy tokens, like Ethereum (ETH) and Chainlink (LINK), which approve owners particular legal rights or accessibility to services within a blockchain community. These symbols often fuel decentralized applications (copyright) and wise agreements.

Comprehending these kinds of cryptocurrencies is critical for beginners aiming to navigate the complicated electronic currency market efficiently. Each type uses special functions that deal with various customer needs and investment approaches.

Establishing a Digital Pocketbook

Setting up a digital wallet is a vital action for any individual aiming to involve in the copyright market. An electronic pocketbook works as a safe and secure setting for saving, sending out, and obtaining cryptocurrencies. There are try these out numerous sorts of budgets offered, including software application purses, hardware wallets, and paper wallets, each with distinct attributes and degrees of safety.

To start, select a purse type that straightens with your demands. Software program budgets, which can be desktop or mobile applications, offer convenience and convenience of use, making them suitable for frequent purchases. Hardware wallets, on the various other hand, give improved safety and security by storing your exclusive secrets offline, making them perfect top article for long-term capitalists. Paper purses involve publishing your personal tricks and QR codes, using a totally offline solution, however require mindful managing to avoid loss or damages.

When you pick a purse, download or acquisition it from a trusted resource and follow the configuration instructions. This usually entails creating a safe password and backing up your recovery expression, which is essential for recovering accessibility to your funds. By taking these steps, you will certainly lay a solid foundation for your copyright activities.

Risks and Benefits of Investing

Nevertheless, these advantages include significant dangers. Market volatility is an essential problem; copyright rates can rise and fall significantly within short periods, leading to potential losses. The lack of regulative oversight can expose investors to fraudulent systems and market adjustment. Safety is one more problem, as digital wallets and exchanges are at risk to hacking, causing the loss of possessions.

Financiers should likewise be mindful of the technological intricacies and the rapidly progressing landscape of visit this site right here cryptocurrencies. In recap, while investing in cryptocurrencies uses enticing chances, it is essential to evaluate these versus the inherent dangers to make enlightened choices.

Conclusion

Finally, a fundamental understanding of cryptocurrencies is vital for browsing the electronic financial landscape. Understanding of blockchain innovation, the numerous sorts of cryptocurrencies, and the process of setting up an electronic pocketbook is crucial for safety. In addition, recognition of the inherent risks and benefits connected with spending in this unpredictable market is essential for informed decision-making. Embracing this knowledge can empower individuals to engage confidently with cryptocurrencies and harness their capacity in the advancing economic ecosystem.

Report this page